Optional category description.

As a full time agent, I am always looking for a deal and always interested in estate sales. Estate sales are homes of deceased or older people who have an executor who manages affairs. I love estate sales because they are typically properties that have been lovingly lived in, and just need the typical updates-…

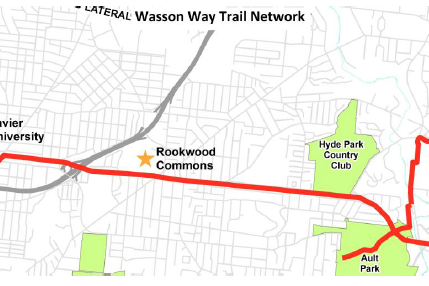

Why should you buy a house with a railroad behind it tomorrow? Because in a few years, your rate of return will be both in the form of money and enjoyment! The corridor which stretches from Fairfax to Avondale is a transformative project connecting neighborhoods that have plenty in common that they will be successful.…

Financing a renovation is a challenge for many people. But depending on debt ratios and equity in the house, the opportunities are actually very plentiful. Depending on when, how and why you’re buying the property, a customized plan should be made for you with your lender and financial planner. Three common options for renovation…

In a sellers and shifting market, strong financing is the best offense. The value of a relationship with a verified lender can be the difference between a contract that will not see closing and a successful transaction. It’s the fiduciary duty of the agent to verify and vet the buyer for his or her client.…